For many North Carolinians, understanding and resolving tax debt can be difficult especially if you have no background in taxes. This is compounded by the need to deal with federal IRS processes and specific state tax laws applicable in North Carolina.

Understanding these processes and local regulations can be overwhelming. It not only helps in effectively managing or even reducing your tax obligations but also in avoiding potential legal consequences. The IRS and the North Carolina Department of Revenue have their distinct sets of rules and relief options. This will require a thorough knowledge and strategic approach to handle your tax debt situation efficiently.

In this blog, we will explore several key strategies to manage and resolve tax debt, tailored specifically for residents of North Carolina. We’ll discuss verifying your tax debt, negotiating payment plans, understanding offers in compromise, and leveraging local tax relief programs.

Moreover, the complexity of these issues often means that professional guidance is not just beneficial; it’s essential. We will highlight the importance of enlisting the services of specialized legal professionals like J. David Tax Law . This firm is well-versed in North Carolina and federal tax laws, ensuring that you have an expert partner through your tax resolution.

Tax debt in North Carolina, as in other states, accumulates when taxpayers fail to pay the full amount of taxes owed by the due date. This can include federal income taxes, state income taxes, sales taxes, and property taxes. There are several common reasons why individuals and businesses fall into tax debt:

It’s important for North Carolinians to understand the differences between federal and state tax obligations to effectively manage their tax responsibilities:

These are collected by the IRS and include taxable income, payroll for Social Security and Medicare, and capital gains. Federal tax laws provide various relief programs, such as installment agreements and offers in compromise. Once you get a delinquent notice, calling an experienced tax attorney as soon as possible can help mitigate your penalties.

Managed by the North Carolina Department of Revenue, state taxes include income taxes and sales taxes, among others. NC has its own set of rules for tax collection, penalties, and debt resolution options that may differ from federal guidelines.

North Carolina tax laws offer several avenues for taxpayers to resolve outstanding debts. Understanding these laws is crucial in developing a strategy to tackle tax debt:

These state-specific programs are designed to provide relief and facilitate compliance. Seeking the advice of a tax professional familiar with both IRS and North Carolina tax laws, such as those at J. David Tax Law, can be invaluable in effectively resolving tax debts. This expertise ensures that all potential relief options are considered, and taxpayers take the most appropriate steps toward clearing their tax liabilities.

Every taxpayer in North Carolina is entitled to certain rights that protect them during their dealings with tax authorities. These rights include:

While taxpayers have rights, they also have responsibilities that are crucial to the resolution of tax issues:

Adhering to tax deadlines and procedural requirements is a crucial responsibility for all taxpayers, especially those dealing with tax debt:

Filing Deadlines: Tax returns must be filed by the due date, including extensions. Late filing can result in penalties and interest that add to the tax debt.

Payment Deadlines: Even if you file an extension for your tax return, any taxes owed are still due by the original filing deadline. Late payments will incur penalties and interest.

Responding to Notices: If you receive a notice from the IRS or the North Carolina Department of Revenue, it is important to respond by the specified deadline to avoid further penalties and possible legal action.

Understanding and fulfilling these responsibilities while exercising your rights can significantly influence the outcome of your tax debt situation in NC.

Tax debt resolution programs are options that provide pathways to potentially reduce the burden of tax liabilities and achieve financial stability. There are several key resolution strategies available under both federal and North Carolina state tax laws.

One of the most accessible ways to manage tax debt is through payment plans, which allow taxpayers to pay off their debt in more manageable installments over time.

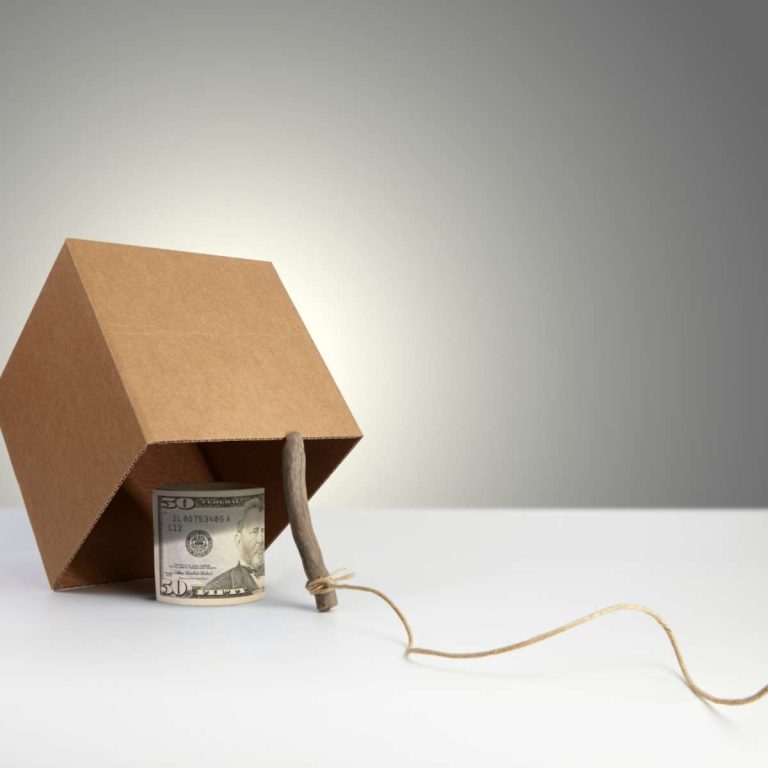

An Offer in Compromise allows taxpayers to settle their tax debt for less than the full amount owed if paying the full debt would cause financial hardship. This can also be resorted to if there is doubt as to the liability or collectability of delinquent taxes.

At a federal level of an OIC, IRS accepts this offer based on three grounds:

Taxpayers need to demonstrate that they meet the IRS criteria through detailed documentation of their financial situation. They also need to be notified about the overdue taxes and secure an installment payment agreement if necessary.

Similarly, North Carolina offers an OIC program. Applicants must provide comprehensive financial information and prove that paying the full amount would create significant financial distress.

Successfully going through with your tax relief options requires a structured approach. Each step of the process is designed to ensure that you can effectively manage your tax debt with the best possible outcome. Here’s how to utilize these relief options effectively:

J. David Tax Law can provide invaluable assistance in getting the suitable relief that you need. This firm can help you understand your rights, prepare the necessary documentation, and negotiate with tax authorities. Tax attorneys can help you secure a resolution that minimizes your tax debt burden while ensuring compliance with tax laws.